Debt, true debt, debt payments and what about raising taxes?

In a recent blogpost, Bruce Bartlett, who served both Ronald Reagan and Bush Sr., discusses the US government debt. Bartlett bases his analysis on an often ignored source: the Financial Report of the United States Government, published annually by the treasury.

Jan 3, 2012

A couple of lessons stand out, from the analysis:

1. Government debt is more than just federal debt. Much more, in fact. That may seems obvious. But wait until you read the numbers. In 2011, Federal debt (past deficits summed up, minus past surpluses summed up) was USD10.2 trillion (on September 30). However, add to that USD5.8 trillion owed to federal employees and veterans, unfunded social security liabilities of USD9.2 trilion (over the next 75 years) and Medicare's unfunded liabilities of USD24.6 trillion.

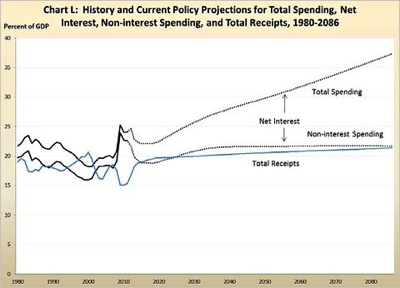

2. The effect of cutting future expenses on the net debt position is marginal. To see why, consider the chart from the report, reproduced below. Most of the debt spending is on interest.

3. In the words of Bartlett: "[T]he critical point is that interest on the debt is not just another government program that can be cut. It can be reduced only by running a budget surplus, selling assets to reduce principal or reducing the interest paid on the debt.

So what about those options? Well, interest rates are not going to drop much more (they cannot). And reducing the maturity of the debt (another way to lower interest rate payments) has already - successfully - been pursued since the Clinton years. Selling assets? Not likely given the current state of the economy.

Reproduced from Financial Report of the United States Government

Bartlett does not say it out loud, but the numbers suggest that raising taxes to facilitate in running a surplus and reduce the net debt position may seriously be worth considering … Especially (have another look at the above chart) since every dollar used that way will lead to a reduction in future interest spending for a long, long time…..